Asset-Based Loans turn your business assets into immediate funds

What are Asset-Based Loans?

Asset-based loans allow businesses access to working capital through a loan secured by assets that the business has. This means that for this type of loan, the lender is collateralized with an asset (or assets) of the business borrower. Ultimately, this can allow for lower rates as this type of financing is considered less risky compared to unsecured lending. It is important to note that the more liquid the business asset is, the less risky the loan may be considered which can possibly mean lower rates.

Since businesses have to have collateral in order to secure an asset-based loan, lenders will lend funds based on the secured assets’ value and type of asset. Please note, the financing available may vary from lender to lender and also depends highly on the type of collateral that the business has. An asset-based loan is a secured business loan which differs from unsecured business loans. The biggest advantage for borrowers is that this type of financing is considered less risky for lenders and therefore can have bigger benefits than unsecured loans.

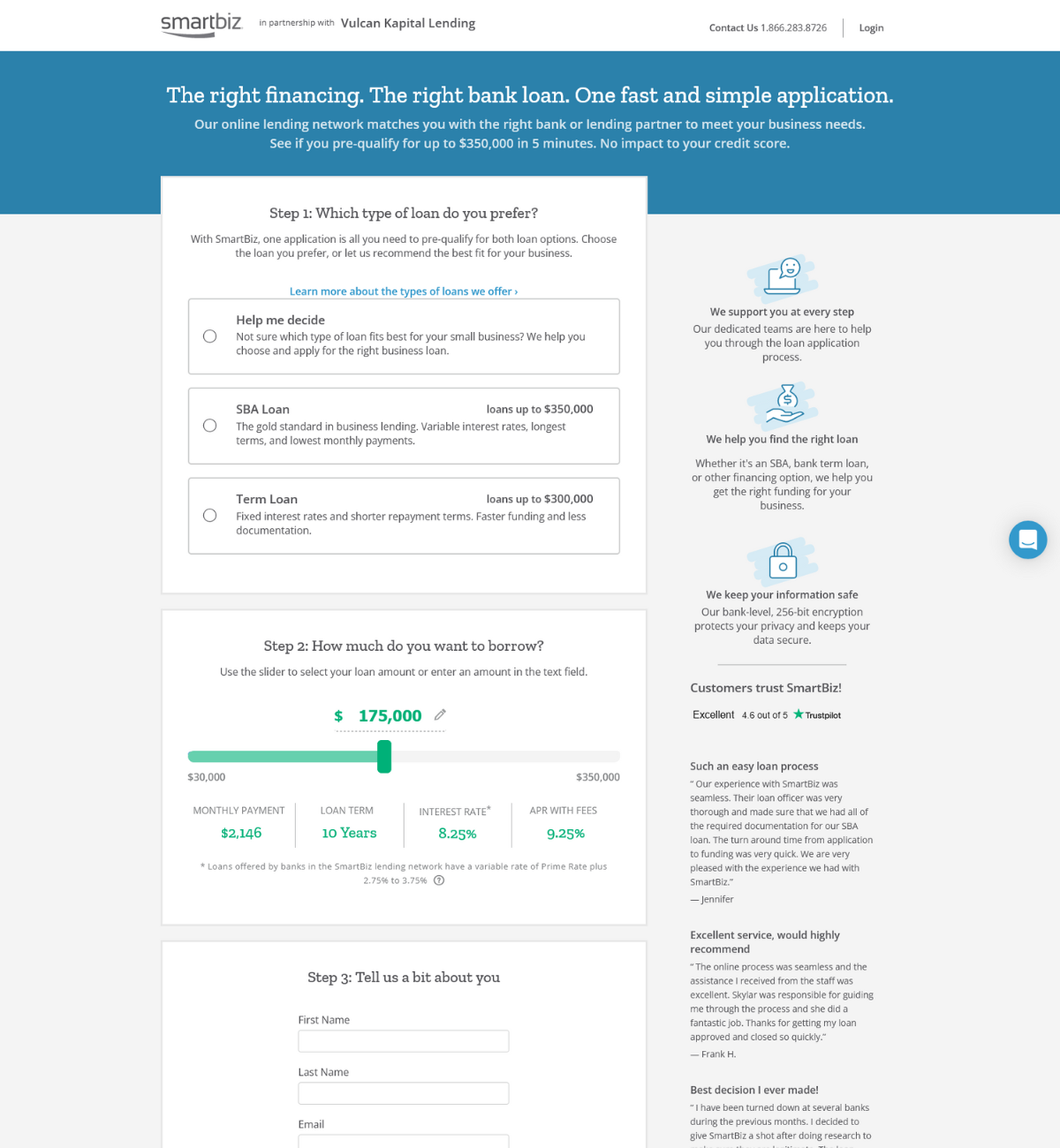

Loan Amount*

Loan amounts starting at $50,000 and range up to $10 million.

Loan Terms*

Loan terms starting at 6 months ranging up to 36 months.

Payment Frequency*

Fixed daily, weekly or monthly payments.

*An estimated completion date is calculated based on the estimated time it will take the business to deliver the receivables (which will vary based on the business’ performance). These estimated completion dates typically range between 3 months up to 18 months, but this is only an estimate.

Asset-Based Loans turn business assets into immediate working capital

All you need are 2 important documents to apply.

Form of identity validation

Last three months of business bank statements

Application Process

Apply Online

You can apply online from anywhere and on your device. Just click the GET QUOTE button at the top of the page. Let us know about your company and your goals, and remember to collect the necessary documentation.

Let us review

Our team will review all the information provided to us. If we need additional information, our team of business advisors will reach out to let you know.

Get Funded

If approved, your business will receive the funds in its business bank account.

Asset-Based Loans FAQ

Asset-based loans work by granting approved businesses quick access to working capital by securing the loan through business assets. Most lenders regularly use the loan-to-value ratio as a way to determine the amount of money they are willing to approve to each business applicant based on the amount of business assets. In the event of a default on an asset-based loan, the lender may be able to take or sell the asset to pay-off the remaining balance on the loan.

Any business with the required type of assets can apply for an asset-based loan. Please note, if the business has a great history of financial statements, commonly sold inventory, and reputable clients among other things, then they have a better chance of securing this type of loan. Usually manufacturers, distributors, and service companies are best suited for this type of loan as they have seasonal business needs that require immediate access to working capital and have assets that they can use to secure a loan.

Because businesses applying for an asset-based loan are using their business assets as collateral to obtain financing, this allows for the loan to be considered less risky by the lender. The less risk the better the benefits offered may be. In most cases, this type of business financing allows for lower rates.

Assets are business collateral that is used to secure financing whose value in the market is equal to or similar in value to the size of the loan amount needed. Accounts receivables, equipment, real property and business bank accounts are the most common type of asset used to secure this type of financing, however, there are additional types of collateral that lenders may accept as collateral. It’s important to note that the amount of funds the business may be eligible to borrower can be dependent on the value of the business assets.

The requirements for asset-based loans vary by lender. As a general rule, most lenders provide this type of financing to businesses that are considered stable (shown through past bank business bank statements and payments on prior financing) and have a larger amount of assets that can be used as collateral for the business loan.

The type of business assets vary by lender, however as a common rule, assets that may be taken into consideration for this type of financing can be accounts receivable, inventory, marketable securities, and property, among others.