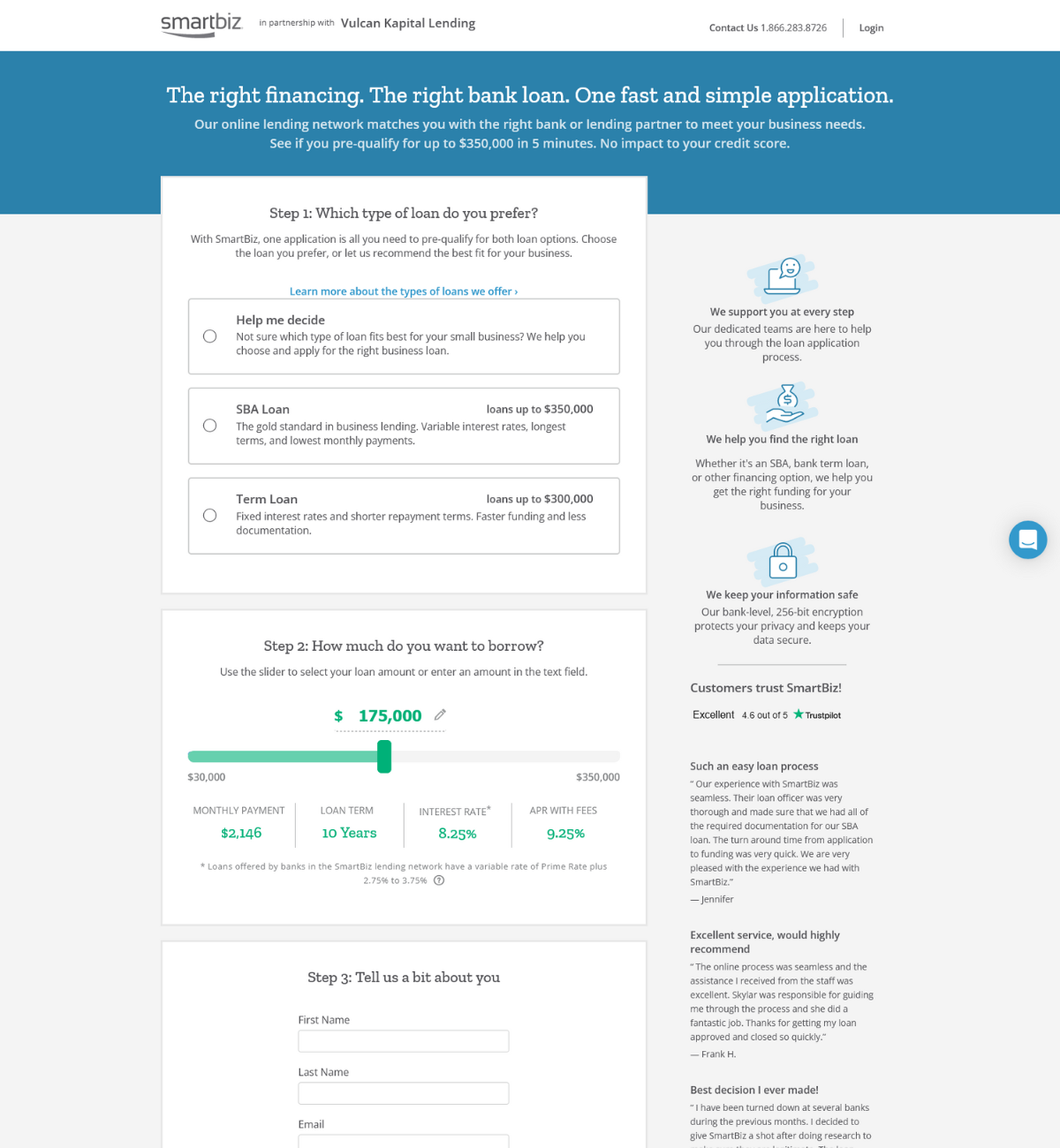

A Line of Credit that businesses can depend on

Our line of credit gives your business access to the working capital it needs when it needs it the most.or.

What is a line of credit?

A line of credit is a flexible business financing option that allows quick access to a defined amount of working capital. The way it works is a business is approved for a set amount of credit and has access to that amount through a streamlined process which allows for quick and easy access to draw on the approved amount when needed. The full approved amount does not need to be drawn at one time, but rather you can choose to draw only the funds your business needs when needed up to the approved amount. Businesses are only responsible for repayment of the outstanding combined balance on the draws plus any interest or other fees that may be charged.

Rapid Finance’s line of credit is extremely flexible and gives your business access to the working capital it needs whenever it needs it most. As mentioned in our financing solutions page, a business line of credit is ideal for repeat cash flows needs. This is a great option for obtaining working capital to pay for unexpected expenses or exciting new business opportunities. Rapid Finance facilitates access to line of credit financing from $5,000 up to $250,000*. Best of all is that the amortization terms can vary from three to eighteen months and may reset every time capital is drawn from the account*. Payments on the outstanding line of credit balance may be made by either fixed daily, weekly, or monthly payments that are automatically withdrawn from the business bank account on file*.

Flexible Payments

Payments are automatically withdrawn from the business bank account.

Term Options*

Amortization can be from 3-18 months. Term may reset every time you draw capital.

Cost and Fees*

An interest charge or fixed fee will be charged. Other fees may also be charged.

Lines of Credit allow access to funds when businesses need it the most.

All you need are 3 important things to apply.

Form of identity validation

Business bank account number and routing

Last three months of business bank statements

Application Process

Apply Online

You can apply online from anywhere and on your device. Just click the GET QUOTE button at the top of the page. Let us know about your company and your goals, and remember to collect the necessary documentation.

Let us review

Our team will review all the information provided to us. If we need additional information, our team of business advisors will reach out to let you know.

Get Funded

If approved, your business will receive the funds in its business bank account.

Line of Credit FAQ

The type of product that is ideal for your business truly depends on the need for the capital, the desired repayment terms, and the amount of capital needed, among other business related factors. A loan is ideal for businesses looking for a traditional type of financing, with a higher capital amount, and potentially longer repayment terms. A line of credit is ideal for businesses that have repeated cash flow needs, as well as for those businesses only looking for fast access to capital to pay-off unexpected costs or for an unexpected opportunity. A line of credit will give your business access to an approved amount of funds that can be drawn when needed and you will only be responsible for paying back the amount of money drawn along with any fees or costs. If the business draws less than the approved amount, you don’t have to pay back the entire approved amount, only what was used along with any costs or fees. However, with a loan, the business needs to pay back the entirety of the loan including the associated interest charge or fixed fee.

a. In order to determine whether or not your business should apply for a line of credit or a credit card, depends on how much working capital you are looking for, whether or not you prefer a set term and payments or if you’re looking to get some perks. A business credit card usually has a set credit limit, which can be used at any time, and some cards come with certain perks (cash back), monthly payments and a set interest rate. A business line of credit can potentially have a higher line of credit amount (depending on what the business is approved for), has daily or weekly or sometimes monthly payments and has set terms (which may reset on every draw). A business line of credit might be better if you’re looking for a higher approved amount, set repayment terms and daily or weekly payments, whereas a business credit card could be useful if you’d rather get additional perks.

b. A line of credit is a great option for businesses that have repeat cash flow needs or want to have capital ready for any type of business opportunity. This type of product allows a business owner flexibility and access to working capital which is ideal for those unexpected financial hardships or incredible opportunities.

Applying for a business line of credit at Rapid Finance is rather simple. It starts with submitting an application online. During the application process we will ask a few questions about the business and request some additional information, such as the owner’s information, last three months of bank statements, verification of identity, business information, and a business checking account. If we have any further questions, our team of dedicated business advisors will reach out to you. If approved, your business will have access to draw on the approved line of credit through our online client portal.

Getting a business line of credit does not have to be hard, and we made it our goal to make the process as easy and convenient as possible.

A line of credit works by giving the approved business access to working capital that it can draw at any given time. That business is responsible for paying back the drawn amount and any associated interest charges or other fees. Payments are automatically withdrawn from the business bank account in either daily, weekly or monthly payments. Amortization can be from 3-18 months, and may reset every time the individual draws capital from the account.

Your business can draw from its approved line of credit and the amount drawn will be deposited into the business bank account The business can use the funds for its desired business purpose.

Yes, if you interested in applying for a business line of credit and would like to calculate what your business may qualify for and what estimated payments may be prior to applying, you can use our line of credit calculator available here.