Commercial Real Estate Loans help secure the property your business needs

Commercial real estate loans help businesses secure financing for their commercial property needs.*

What is a commercial real estate loan?

Commercial Real Estate Loans help secure the property your business needs. Commercial real estate loans help businesses secure financing for their commercial property needs.

Commercial real estate loans are ideal for businesses looking to either purchase, develop or construct new property as well as current commercial property. The way it works is businesses can apply for this type of financing in order to secure a loan (may also be referred to as mortgage for this specific financing) which itself is secured by liens on the commercial property. As the name states, this is for commercial properties only and not for residential properties. Understanding that this loan is for commercial real estate, the terms and rates may differ from a traditional residential mortgage.

The use for this type of financing can vary, meaning the business does not have to acquire new property in order to apply. This loan can cover expenses such as refinancing, or renovations needed on current business real estate in addition to covering new real estate property. Small business owners or even large corporations may be eligible for this type of loan. Keep in mind, this type of financing is very different to a traditional residential mortgage that you would apply for when purchasing or refinancing a residential property. Aside from different terms and rates (as mentioned above) the requirements and application process vary as well.

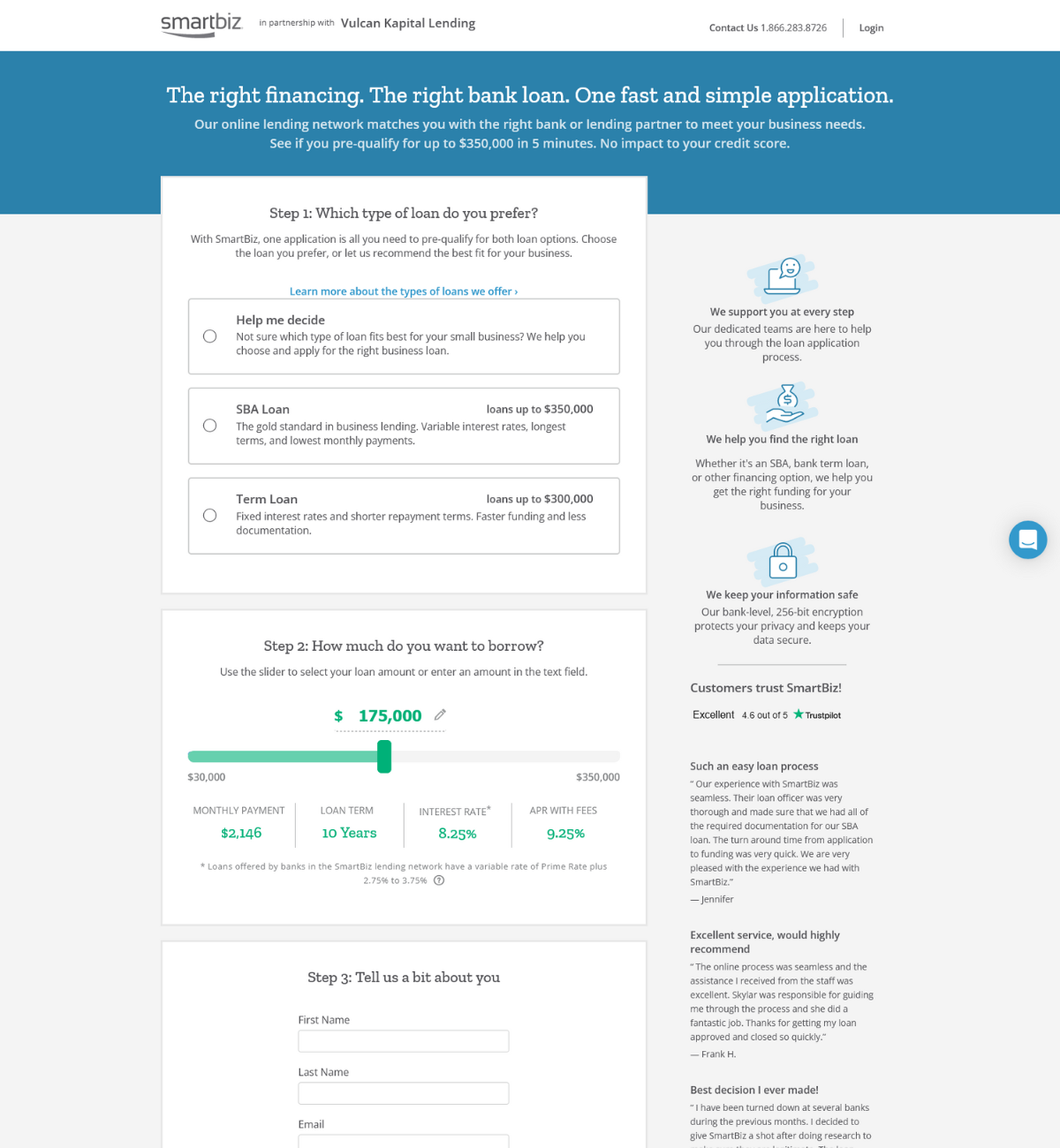

Loan Amount*

Loan amounts starting at $75,000 and range up to $2 million.

Loan Terms*

Loan terms starting as low as 5 years ranging up to 20 years.

Payment Frequency*

Monthly payments from an account on file.

*An estimated completion date is calculated based on the estimated time it will take the business to deliver the receivables (which will vary based on the business’ performance). These estimated completion dates typically range between 3 months up to 18 months, but this is only an estimate.

Commercial Real Estate Loans assist with your business property needs

All you need is 3 important documents to apply.

Form of identity validation

Two years of tax returns or financials

Schedule of debts

Application Process

Apply Online

You can apply online from anywhere and on your device. Just click the GET QUOTE button at the top of the page. Let us know about your company and your goals, and remember to collect the necessary documentation.

Let us review

Our team will review all the information provided to us. If we need additional information, our team of business advisors will reach out to let you know.

Get Funded

If approved, your business will receive the funds in its business bank account.

Commercial Real Estate Loans FAQ

Commercial real estate loans work by granting approved businesses with the working capital needed to either purchase a new commercial property, refinance, or work on renovations for current commercial real estate. The loan itself is a mortgage that is secured by liens on the commercial property. Lenders will take into consideration the loan-to-value ratios which means the process for getting approved for this type of loan can vary greatly from a traditional residential mortgage.

Any company whether a small business, mid-sized company, distributors, or large corporations that has the intention of either purchasing new commercial property, renovate current commercial property, or refinance a current commercial mortgage. Remember, this is for property for commercial use only.

A commercial real estate loan makes sense for your company if you have the intention of using the working capital for commercial real estate. This type of loan will not work for primary or secondary residential residence. In addition, a few things to keep in mind is that the interest and repayment terms vary greatly from a residential mortgage.

Yes, you may access our commercial real estate loan calculator here to get an estimate.

Requirements for a commercial real estate loan vary depending on the lender and type of loan your business is looking to apply for. As a general rule, lenders will take into consideration your business financial statements, your company’s debt service coverage ratio, property characteristics such as property use and value, percentage of expected/current occupancy, among other requirements.

The commercial real estate loan rates truly depend on the lender the business is looking to work with in addition to the type of loan that you are looking to apply for in order to secure a mortgage for the commercial real estate, or refinance. As mentioned, the rates are very different from a traditional residential mortgage loan so please take this into consideration before applying.